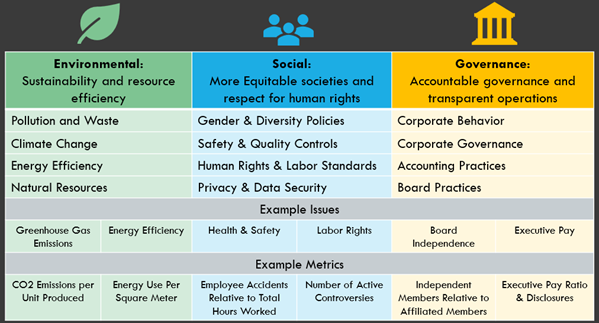

I have raised the issue of ESG (Environmental, Social, and Governance) investments in earlier blogs. A blog from this summer (August 16, 2022) delves into the details of the acronym, shown again in Figure 1. That blog also describes how the concept has started to penetrate global markets.

Figure 1 – Details of ESG

As with many other parts of our life, the concept is now being seriously polarized—to the degree that now both houses of Congress have passed a law forbidding pension funds from considering ESG as a factor for investment:

Often known as E.S.G. investing, this approach takes its name from the environmental, social and governance factors that are used by millions of people in countless investment, business, lifestyle and government policy decisions every day.

In the financial world, trillions of dollars have been placed in investments that take E.S.G. issues into account. “E.S.G. investing is now totally mainstream,” said Jon Hale, head of sustainable investing research for Morningstar. “It’s part of the thinking of every major investment company because, at its core, it’s just common sense.”

Yet as this approach has grown in popularity, it has set off a powerful political backlash. That was evident in Congress this past week, when the House and Senate approved bills aimed at restricting E.S.G. investing in workplace retirement accounts in the United States.

The White House has said President Biden will veto the legislation, so what happened in Congress won’t have immediate effects.

The Republican party was solid in voting for the law in both the House and the Senate and two Democratic senators joined them in facilitating its passage. President Biden promised to block the law and followed through:

More than halfway through his term, US president Joe Biden had yet to use his veto power. But that changed after the US Senate voted earlier in March to block a US Labor Department rule that would have allowed retirement plans to consider environmental, social, and governance (ESG) factors in their investments.

Democrats argued that the Labor Department rule was neutral: Retirement funds could either choose to invest in ESG funds, or not. But Republican opponents have turned ESG into a political lightening rod, deriding it as a form of “woke” capitalism at odds with the needs of average Americans.

US pension funds manage over $20 trillion dollars (pdf) in assets and retirement savings, according to the OECD.

Congressional override of the presidential veto has failed. Joe Manchin, one of the two Democratic senators that joined the Republicans in passing the law, responded to the president’s veto:

Sen. Joe Manchin (D-WV) blasted President Joe Biden’s veto of a congressional resolution to cancel a Labor Department rule allowing retirement fund managers to consider environmental, social, and governance guidelines when making investment decisions.

Manchin said Biden’s ESG policy “prioritizes politics over getting the best financial returns for millions of Americans’ retirement investments.”

“Despite a clear and bipartisan rejection of the rule from Congress, President Biden is choosing to put his Administration’s progressive agenda above the well-being of the American people,” Manchin said in a statement.

“This ESG rule will weaken our energy, national and economic security while jeopardizing the hard-earned retirement savings of 150 million West Virginians and Americans,” he said.

The law basically forbids those in charge of investing public funds from considering the issues mentioned in Figure 1 as factors in future profitability. To state it differently, investors can only consider present profitability and must ignore probable future impacts of broader issues that directly impact all aspects of our lives. This decision is being made when the world— in so many ways—is in upheaval.

The economic impacts of the Russian invasion of Ukraine and the global impacts of COVID-19 were discussed often in recent blogs. The resulting global inflation and its direct impacts on interest rates are a bit more recent.

Over the last two weeks, instabilities and outright defaults of banks both in the US and Europe have brought the smell of disaster to many of us. An op-ed in the NYT comments on the mess:

We were hours away from the failure of two regional banks and, more precisely, the new widespread recognition that deposits in excess of $250,000 might not be safe, setting off a chain reaction. Customers at other regional banks who thought their deposits were risk-free were suddenly questioning whether they should move their cash to safer havens. Withdrawals began, and as a result, previously remote risks of failure became real.

Unfortunately, the bipartisanship of last weekend has faded, and the blame game has begun. Progressives claim that greater regulation would have prevented the failure. Others claim that the failures were the result of a shift in regulatory focus from prudence to socially oriented directives.

Both claims are off base. Worse, this opportunistic political rhetoric may distract us from both the risks of the moment and, as we look forward, the critical role banks play in our society.

France is up in arms because its government is taking the “drastic” step of increasing its retirement age from 62 to 64 (see March 7, 2023 blog). Israel is up in arms because the new administration, nervous about how long it can hold power, has decided to make drastic changes to the structure of government (while it still can) by giving the Knesset control over the judiciary.

Figure 2 shows a self-portrait of my high school roommate (5 years after the establishment of the State of Israel) in front of what has become a weekly demonstration. He wasn’t even the oldest there—a group of ladies over 90 years of age—some of whom took part in the War of Independence—were also among the demonstrators, often with their kids and grandchildren.

Figure 2 – A recent demonstration in Israel through the eyes of a friend

Michael Bloomberg’s comments on the immediate impact of the instabilities on the Israeli economy are shown below:

Under the new coalition’s proposal, a simple majority of the Knesset could overrule the nation’s Supreme Court and run roughshod over individual rights, including on matters such as speech and press freedoms, equal rights for minorities and voting rights. The Knesset could even go as far as to declare that the laws it passes are unreviewable by the judiciary, a move that calls to mind Richard Nixon’s infamous phrase “When the president does it, that means that it is not illegal.” Prime Minister Benjamin Netanyahu’s government is courting disaster by trying to claim that same power, imperiling Israel’s alliances around the world, its security in the region, its economy at home and the very democracy upon which the country was built.

The economic damage is already being felt, as the pummeling of the shekel has shown. A large number of business leaders and investors have spoken out against the government’s proposal, publicly and privately. And in a disturbing sign, some people have already begun pulling money out of the country and re-evaluating their plans for future growth there. As the owner of a global company, I don’t blame them.

These are trying times for all of us. Stay tuned.