Hello! Happy belated Earth Day and happy 7th birthday to the Climate Change Fork blog! We are guest bloggers Nataly Azouly and Anelisa Defoe. Respectively, our majors are Actuarial Mathematics (BS) with a minor in Physics, and Physics (BA) and Exercise Science (BS). We will graduate from Brooklyn College CUNY in May of 2019. Under the guidance of Micha Tomkiewicz, PhD, we have been able to use our backgrounds and experiences to better understand the importance of regulating carbon emissions for the benefit of our planet.

A carbon tax in the US was initially proposed in 1990 in response to the IPCC’s First Assessment Report, as a measure for reducing greenhouse gas production. It was met with bipartisan opposition repeatedly until the late 2000s, when the 2007 IPCC Fourth Assessment presented more aggressive evidence of global warming1. The 2016 Paris Agreement emphasized the importance of reducing the carbon footprint worldwide, mandating that signatory nations make a joint commitment to reinforce efforts to mitigate climate change2. Implementing a carbon tax in the US presented an effective means for discouraging the consumption of energy from nonrenewable sources while promoting clean energy alternatives.

Presently, there are no active carbon tax policies enforced at either state or federal levels in the US. A 2016 publication by the Congressional Budget Office proposed a plan for an annual increase of revenue through carbon taxation3. This initial, forceful approach to carbon taxation planned to generate $32.9 billion between 2017 and 2018. A trend of 2% annual increase in the tax would be implemented and result in a net federal revenue increase of $977.2 billion between 2017 and 2026. Consequently, businesses’ costs would increase while income and payroll taxes decreased. If approved, CO2 emissions would be taxed $25 per metric ton based on CO2e (equivalents) necessary to cause warming. Carbon emissions would be predicted to decline by 9% within the 1st decade of enforcing carbon taxes. The proposal offers a model for state governments to adopt and modify the measure for an optimal increase in revenue. However, the plan has not been passed into law anywhere.

Oppositional arguments against a carbon tax assert that reducing US carbon emissions would destabilize the economy by increasing cost production of emission-intensive goods and services. Indeed, without empirical data to reference, the socioeconomic risk-benefit ratio for residents is uncertain. Therefore, it is plausible that a reduction in climate change might more immediately benefit other countries, particularly developing ones, as opposed to the US. Another argument suggests that industries with high emission rates might simply relocate to other countries that have minimal restrictions on the use of nonrenewable resources. Consequently, the carbon tax would prove ineffective overall in reducing the global carbon footprint.

A January 2019 publication by the Center for Climate and Energy Solutions (C2ES) reports state efforts to target the transportation sector4. The sector’s increase in carbon emissions nationwide between 1990 and 2016 attests to the need for regulation. At present, 14 states have proposed legislation to encourage a transition to zero emission vehicles (ZEV). ZEVs include both plug-in and fuel cell electric vehicles, thereby deviating from the use of traditional gas for motor vehicles. Under section 209 of the Clean Air Act, California has the ability to spearhead operations that place greater restrictions than the federal government on carbon emissions. Similarly, under section 177 of the Clean Air Act, states such as New York, New Jersey, Colorado, and others may enforce comparable policies reflective of California’s precedent.

At the congressional level, the cap and trade model serves as the primary mode for reducing carbon emissions5. Instead of taxing emissions, the government limits how much carbon various factions may produce. These limitations are measured in metric tons that companies and other groups may not exceed. This model serves the interests of the private sector more effectively than it reduces net carbon emissions. As observed in other countries, a carbon tax would yield greater results for reducing emissions.

On a global scale, economists endorse the carbon tax as being the most effective tool for both reducing the carbon imprint6 and encouraging the advent and refinery of prospective technologies. Its implementation in an array of countries demonstrates that its success rate is dependent on the dynamic systems that constitute a particular society.

A March 2016 New York Times publication confirmed the difficulty of British Columbia’s (BC) task to institute a carbon tax7. Between 2008 and 2012, carbon emissions there fell 10%. With a tax of about $22.20 US per ton of CO2 emissions, revenues stimulated the economy and gradually gained voter acceptance. However, in response to stagnation in the tax’s growth, carbon emissions began to increase. To continue reducing the carbon imprint via taxes, BC must increase the tax at a rate of $7.46 US per ton annually. This task has been met with the above-mentioned challenge of preventing businesses from relocating to other countries with fewer restrictions on carbon emissions.

Anthesis Enveco’s March 2018 overview of Swedish carbon tax details a successful 26% decrease in carbon emissions between 1991 and 20168. It is noteworthy however, that Sweden has a historical affinity for renewable energy resources to substitute fossil fuel consumption; in juxtaposition, BC has a far greater dependence on companies that are incentivized by cheaper nonrenewable energy. Sweden has access to biomass and hydropower to generate energy. Furthermore, the country’s carbon tax is complemented by legislation that predates it—including a cap and trade model—as well as a transition to ZEVs (like the US), and a combination of prolific resources and government initiatives.

Similarly, Norway implemented a carbon tax in 1991. The target goal is to have a 40% reduction of carbon emissions, relative to the 1990s, by 20309. Mirroring Sweden’s approach, a carbon tax in conjunction with incentives to transition to battery electric vehicles would further mitigate the carbon footprint. It is also essential to note that—as with Sweden—Norwegian energy systems are already 98% renewable. Therefore giving up reliance on coal-based energy sources does not present the same adversity as it does in British Columbia.

Our Analysis

A carbon tax is designed to reduce fossil fuel emissions. Placing a carbon tax on fossil fuels would essentially raise the prices for consumers and force households and corporations to make decisions regarding their consumption of said fuels accordingly. Instead of allowing the market to naturally adjust its price based on supply and demand, issuing a carbon tax would therefore give the government a greater amount of market power, leaving room for alternative energy sources to become competitive.

According to the law of demand (Mankiw), all other things equal, when the price of a good rises, the demand for the good falls. Essentially, an individual or group would be incentivized to consume fewer fossil fuels solely based on an increase in price.

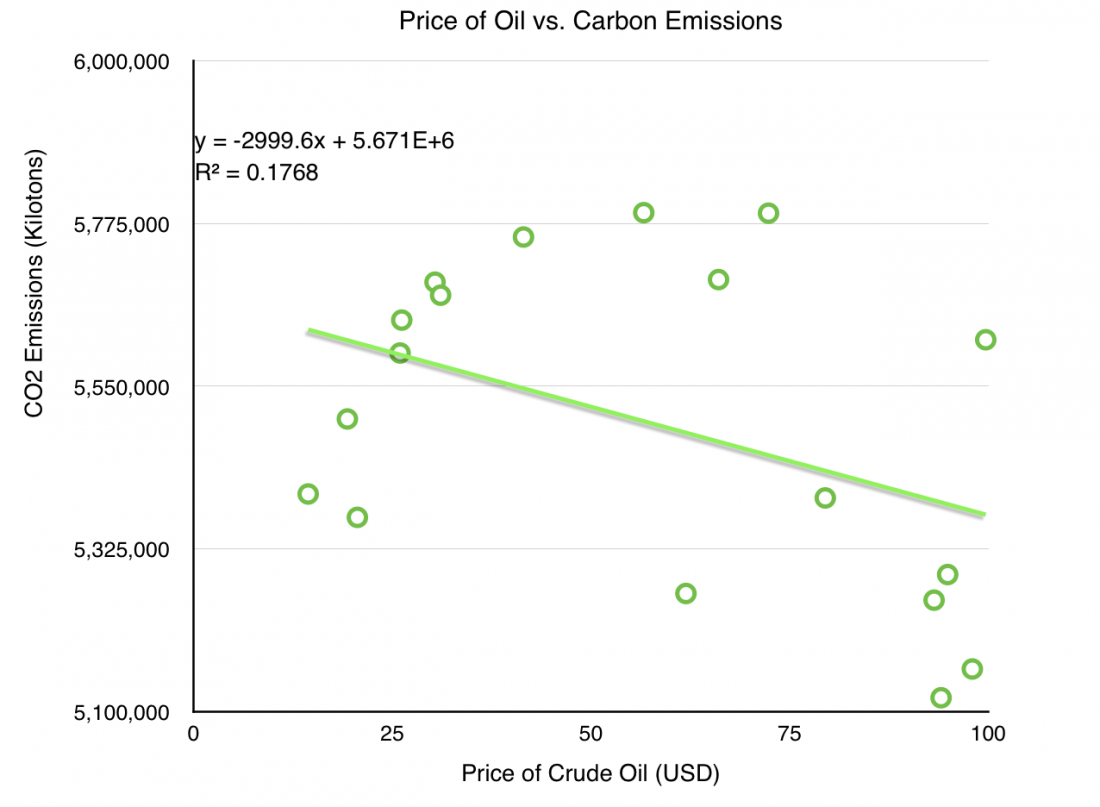

In order to create a demand curve, data was collected comparing the price of crude oil (USD) to the CO2 emissions (kilotons) in the US during the corresponding year. Since 82% of greenhouse gas emissions in the US are a result of the burning of oil, coal, and natural gas, the price of crude oil will be used as a proxy to represent the price of fossil fuels in the United States. In addition, CO2 emissions will be used as a proxy to represent fossil fuel consumption.

The data we are using was collected from the years 1997 to 2014 by the World Bank and Macrotrends. Our hypothesis states that, based on the nature of the law of demand in macroeconomics, a carbon tax is an effective tool to mitigate CO2 emissions.

First, to evaluate the significance of the price of crude oil in the United States in determining carbon emissions, a regression has been run yielding the following equation:

CO2 = -3000 x Price + 5.7×106

A regression is a measured relationship between the average value of the dependent variable and the input value of the independent variable. In this case, the independent variable is “Price,” the price of crude oil in USD, and the dependent variable is CO2, the carbon emissions in kilotons. Due to the negative coefficient of the price of crude oil in the US, this implies that when the price of oil is increased by $1, the predicted average CO2 emissions decreases by 2999.6 kilotons. Therefore, there is an inverse relationship between CO2 emissions and the price of oil as predicted by the law of demand. This equation can also be used to predict the shape of the demand curve of oil in the United States.

This distribution has an R2 value of 0.18. R2 is statistical measure that explains the proportional effect a variable has on the variation of another variable. In this case, it means that the price of crude oil explains an 18% variation in carbon emissions—a large value for cross-sectional data. This makes it a significant variable in predicting carbon emissions in a given year.

To determine the statistical significance of the variable Price, we will be conducting a one-tailed hypothesis test (t-test). A t-test is used to determine the significance of the hypothesized coefficient produced by the regression. To test H0: A=0 (The hypothesized value) versus H1: A<0 (The alternate hypothesis) at the α level of significance, reject H0 if t is either

(t) ≤ -tα,n−1

Where A is the coefficient of the variable Price.

In this case, t = −1.854 and −tα/2,n−1 = -1.7396. Since −1.854 < -1.7396, we reject the null hypothesis in favor of the alternative hypothesis that the coefficient of the Price is less than 0.

Lastly, looking at the correlation of the variables, Corr(CO2 emissions, price of oil), we find that:

Corr(CO2 emissions, price of oil) = -0.42052344

A negative correlation is a relationship between two variables such that as the value of one variable increases, the other decreases. Therefore, as the price of crude oil increases, CO2 emissions decrease. This can imply that there is an inverse relationship between the price of carbon and its consumption. According to these results, a carbon tax would effectively mitigate the use of fossil fuels in the United States.

Conclusion

Approximately 82% of greenhouse gas emissions in the US are a result of our burning oil, coal, and natural gas. The objective of this research was to determine the effectiveness of a carbon tax to mitigate the use of fossil fuels and reduce carbon emissions. Through observation of countries with successful carbon tax policies, current legislation concerning fossil fuel production and consumption, and statistical analysis, we determined that implementing a carbon tax is an effective tool in mitigating carbon emissions by demonstrating that there exists an inverse relationship between the price of fossil fuels and their consumption.

Our analysis shows that a carbon tax is an effective method to mitigate the use of fossil fuels. The creation of a carbon tax raises the issue of what to do with the tax revenue raised by this new policy. Proposals have included issuing a rebate, investing in clean energy technology, and using these funds to decrease the US government’s deficit. We determined that the best uses for the revenue generated from a carbon tax would be to offer a rebate to lower and middle class individuals while also investing in research for new technologies in clean and renewable energy in order to decrease the costs of renewable energy sources and methods.

References:

1 “Know the Legislation.” Price on Carbon. 4 Jan. 2019, 21 Apr. 2019, https://priceoncarbon.org/business-society/history-of-federal-legislation-2/.

2 “Paris Climate Agreement Q&A.” Center for Climate and Energy Solutions. 7 Jan. 2019, 21 Apr. 2019, https://www.c2es.org/content/paris-climate-agreement-qa/.

3 “Impose a Tax on Emissions of Greenhouse Gases.” Congressional Budget Office, 8 Dec. 2016, www.cbo.gov/budget-options/2016/52288.

4 “U.S. State Clean Vehicle Policies and Incentives.” Center for Climate and Energy Solutions, 15 Feb. 2019, www.c2es.org/document/us-state-clean-vehicle-policies-and-incentives/.

5 Specht, Steven. “Developing an International Carbon Tax Regime.” Sustainable Development Law & Policy, vol. 16, no. 2, 2016, pp. 30–31, https://digitalcommons.wcl.american.edu/sdlp/vol16/iss2/5/.

6 Specht, Steven. “Developing an International Carbon Tax Regime.” Sustainable Development Law & Policy, vol. 16, no. 2, 2016, pp. 29–30, https://digitalcommons.wcl.american.edu/sdlp/vol16/iss2/5/.

7 Porter, Eduardo. “Does a Carbon Tax Work? Ask British Columbia.” The New York Times, 21 Dec. 2017, www.nytimes.com/2016/03/02/business/does-a-carbon-tax-work-ask-british-columbia.html.

8 Scharin, Henrik, and Jenny Wallström. “The Swedish Carbon Tax- An Overview.” 5 Mar. 2018, pp. 17–30, www.enveco.se/wp-content/uploads/2018/03/Anthesis-Enveco-rapport-2018-3.-The-Swedish-CO2-tax-an-overview.pdf.

9 “Putting a Price on Emissions: Polluters Should Pay.” 2 Apr. 2018, www.unfccc.int/sites/default/files/resource/119_TalanoaSubmissionNorway1apr2018END_rev.pdf.

This article very useful.

Thank you for your explanation of a carbon tax. I always thought about using taxes to make using nonrenewable energy less preferable, but I now see that it may not be the best idea in the United States, where the economy is so large. I believe that the use of rebates and rewards for clean energy would be a better alternative. By making renewable sources more desirable, this shift in energy source may occur faster. I also believe we need to educate ourselves and others on how to make the shift from nonrenewable energy to renewable energy because I believe that many companies are resisting the change to clean energy due to the fact they are uninformed on how to make the transition.

The discussion of the implementation of a carbon tax has certainly become an interesting topic for debate, and I appreciate your decision to present information from both sides of the argument. I believe most individuals would agree that a carbon tax would have dramatic effects on the economy of the United States, the question of course is then how dramatic of a change are we willing to make? Your rebate proposition is a interesting idea that I feel would help to mitigate some of the economic change caused by a carbon tax.

This blog was very informative and I appreciate all of the information that you provided. a carbon tax is a tax on the content of fuels. it is a form of carbon pricing carbon is present in every hydro carbon fuel coal, petroleum & natural gas and converted to carbon dioxide co2) and after products when combusted. carbon tax after social and economic benefits it is a tax that increases the economy while simultaneously promotting objectives of climate change policy. the objective of a carbon tax is to reduce the handful and unfavorable levels of co2 emissions thereby decorating climate change and its negative effects on the environment and human health. doesn’t carbon taxes after potentially cost-effective means of reducing green house gas emissions? its help to address the problem of emitters of greenhouse gases not facing the full soical cost of their actions. at least 27 countries implemented taxes by 2018. there are existing research that shows that carbon taxes effectively reduce greenhouse gas emissions.

Thank you Kyle,

The money generated from carbon taxes would open up avenues for many opportunities to reinvest into educating individuals on not only the method and production of renewable energy sources, further investment in STEM would definitely help individuals to begin careers to reduce the carbon footprint. After our science day presentation and speaking to other colleagues, I often reflected on the reality that not enough people understand climate change, or the concerns associated with it. If you were to open a youtube video of Justin Trudeau’s proposal for a carbon tax, the comment section is flooded with confusion about how the tax would be beneficial. Therefore, continuing to educate others on this matter is essential to being able to combat increasing CO2 emissions. I also agree that further investment in renewable energy is also crucial. With technology continuing to adapt, become more compact, and still retain it’s functionality; the cost over time for various innovations will become more affordable.

As for a tax being implemented in the U.S, the interests of the country, and the planet, must outweigh the interests of those in power. As cliché as it may sound. But a recent news development highlight’s recent commentary from the U.S Secretary of State stating that the melting of sea ice would present new opportunities for trade. Before assuming that there is a preference for trade opportunities over climate change, it is important to understand the web-like intricacies of issues and concerns presented by global warming for national security. However, one must also still reflect on the corrosive consequences of not presently taking action to mitigate greenhouse gas emissions. Perhaps STEM may not be the only field worth reinvesting money from a carbon tax?

Finally, I agree that a carbon tax can not be the only means for reducing America’s carbon footprint. It is only 1 tool that works best in conjunction with other devices i.e., policy and innovation.

A link to a CNN article regarding the U.S. Secretary of State’s commentary: https://www.cnn.com/videos/politics/2019/05/07/mike-pompeo-melting-sea-ice-presents-trade-opportunities-pleitgen-sot-nr-vpx.cnn

Thank you Daniel,

My belief is that a carbon tax is only truly effective when implemented in conjunction with renewable energy sources. In reference to Norway and Sweden, due to their access to biomass and hydroelectric power, they did not have to heavily rely on companies that use nonrenewable resources. In contrast to British Columbia, implementing a carbon tax was met with the potential response of companies outsourcing to other countries. Without enough alternatives to provide energy, B.C was at the negotiating end with these companies for preventing loss of business.

With the carbon tax, options such as rebates for households may be offered as a means for mitigating the financial burden. A recent post by the global news states that rebates may actually reimburse households enough to produce a net increase in money. However, due to varying constraints of different countries etc., I strongly advocate for further research and development of technology for cleaner energy sources. This will assist in providing greater ability to reduce reliance on nonrenewable resources; and ease the burden on households that are already conscious of their carbon footprint and expenses.

The aforementioned article link is: https://globalnews.ca/news/5202108/carbon-tax-canada-2019-revenue/

Although you mentioned several possible risks which may arise after implementing a carbon tax, we still need to keep in mind that if a country does implement a high carbon tax, many companies may simply base their operations in other regions. For example, many commercial ships are registered in other countries which have lower taxes. This way, more profit is able to go towards the company itself. If, however, the same thing happens with a carbon tax, companies will simply move to other more favorable regions, like you have mentioned. Since we are overall worried about net carbon emissions throughout the world, this will not make a great difference. Furthermore, a rebate offered to lower and middle classes from the carbon tax does not seem like it would do much. For example, currently, rebates are offered for electric vehicles. The issue remains that EV vehicles are still costly, and there is very little infrastructure to support them. Consider New York City. Even though we would like to see less gas-powered cars, this will not happen. Most people live in residential buildings and do not have a way to charge their vehicles (either because they do not park at home, or because their building garages do not support the wiring requirements necessary to charge an EV for daily use. Instead, a carbon tax seems like it may scare away companies, whilst not doing much in terms of carbon decrease. Unless all countries create a worldwide carbon tax, your proposal may not be feasible. Nonetheless, I am interested in what the authors think about this point of view.

I agree with the bloggers’ point of view. The implementation of a carbon tax by the states will help to reduce the use of carbon fuel. This can stimulate consumers to reduce their dependence on carbon energy in the consumption concept, thereby reducing the amount of carbon used. At the same time, the states should also strengthen the development of new energy sources and make new energy available to the general public. If not, when the new energy supply is insufficient to be used by the public, or its use price is equal to or exceeds the cost of carbon energy use, I believe that the masses are more inclined to use carbon energy because it is familiar to everybody. For reducing the use of carbon energy, carbon tax must be implemented, and the development and promotion of new energy should also be followed.

Carbon tax, first of all, the cost of the enterprise is bound to rise, then it will naturally be passed on to consumers. At the same time, I also think that the place that is very correct is that it is natural that the first large number of intensive labor enterprises will be forced to relocate. Because the requirements in these factories are the lowest, whether for mechanical equipment or workers’ quality requirements, such workers are the most easily recruited in developing countries. The industry, which is originally a low-profit and profit-oriented industry, will naturally go to a place where the cost is lower, and the carbon tax is low or not.

Although the carbon tax will reduce the number of non-essential outings for families with cars, such as the cost of going out due to carbon taxes under the same circumstances. For example, if the price of oil rises, then some long-distance outings will be reduced in the unconscious, which also reduces consumption.

Therefore, according to the conclusion, the carbon tax will inevitably lead to a reduction in the use of fossil fuels. At the same time, I also agree to invest the carbon tax in the development and research and development subsidies for new energy. Just as ordinary people can get on the plane after the popularity of transoceanic flights, as the carbon tax increases and new energy sources continue to spread and reduce costs, both individuals and businesses will have more inclinations in a profitable situation use new energy.

This blog was very informative and I appreciate all of the information that you provided. I was just had a few different comments and questions that I would like to bring up. Firstly, I would like to discuss an alternate possible use for the revenue generated by the carbon tax. I think it would be beneficial to use this generated income in order to provide educational substitutes for fields which are related to renewable energy source creation methods and production. Continually, I think in order to promote the shift from nonrenewable to renewable energy generation money should be used to decrease the cost of renewable energy. I was also wondering why is it that no policy has been effective so far in creating a carbon tax in America and what else could be done to convince those in power to implement this tax. Finally, I would just like to mention that though carbon tax does seem to be effective in reducing carbon, this alone would not be completely effective in reducing Americas carbon footprint.

Thank you Nataly and Anelisa for your insight on this topic. As you guys have stated CO2 emissions have become an issue not only in America but through out the world. I do agree with you that a carbon tax would be better suited for a developing country rather than the United States. Energy and Electricity in modern day have become a necessity to everyday life. I would make an argument that most Americans do try to reduce their use of electricity as much as possible seeing as to how it is not free. Taxing carbon would force many families, specifically low-income families, to pay even more for something that they are trying to reduce already. The tax would only leave a few options for people to reduce their emissions. Option one would be to buy high efficiency appliances which is a very costly option or to switch to cleaner energy sources which is also not cheap or sometimes not even accessible. Speaking from my own personal experience switching to solar energy through a company would lead to a higher electricity bill in the long run and buying the equipment for a DIY installation would be very costly as well. If not for a carbon tax, what other effective ways to reduce our carbon footprints are there?