The last two blogs dealt with insurance against catastrophic damage that is associated with the accelerating impacts of climate change (September 12th and September 19th). Both blogs were focused on the United States. The first was focused on the increasing withdrawal of private insurance companies from vulnerable markets, while the second blog dealt with the complex state of federal contributions to supplement local insurance, mainly through FEMA. Recent coverage of the increasing impact of climate change focused on the destruction of two relatively small towns: Lahaina in Maui, Hawaii, destroyed by uncontrolled wildfire, and Derna in Libya, destroyed by an uncontrolled flood that was amplified by the destruction of two ill-maintained dams. The Lahaina destruction resulted in the death of about 100 people while that in Libya resulted in the death of thousands. Lahaina is in the US and expecting help from the US federal government. Derna is not in the US and the Libyan government is basically nonexistent. Both stories disappeared from the news after only a few days. The survivors from Lahaina will slowly try to recuperate with the help of local and federal funds. What will the survivors of Derna do?

Obviously, Derna and Libya are not alone. Recently, the NYT published an article on the difficulties that most developing countries face in trying to adapt to the increased threats of climate change. The article’s emphasis was on the situation in Ghana, with the full realization that it is common to most developing countries. Below is the most general citation from that article:

Crisis and Bailout: The Tortuous Cycle Stalking Nations in Debt

The debt load for developing countries — now estimated to top $200 billion — threatens to upend economies and unravel painstaking gains in education, health care and incomes. But poor and low-income countries have struggled to gain sustained international attention. In Ghana, the I.M.F. laid out a detailed rescue plan to get the country back on its feet — reining in debt and spending, raising revenue and protecting the poorest — as Accra negotiates with foreign creditors.

Still, a nagging question for Ghana and other emerging nations in debt persists: Why will this time be any different?

The latest rescue plan outlined for Ghana addresses key problems, said Tsidi M. Tsikata, a senior fellow at the African Center for Economic Transformation in Accra. But so did many of the previous ones, he said, and still crises recurred.

The last time Ghana turned to the fund was in 2015. Within three years, the country was on its way to paying back the loan, and was among the world’s fastest-growing economies. Ghana was held up as a model for the rest of Africa.

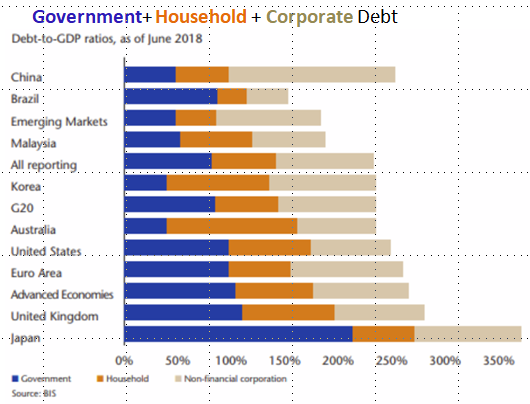

Details about the global debt situation are shown in Figure 1.

Figure 1 – Total debt by country (Source: Seeking Alpha)

On the scale of Figure 1, it seems that there is not much difference between rich and poor in terms of the ratio between the various debt forms and the GDP of the countries (a factor slightly greater than 2 between the largest debt ratio, Japan, and the smallest one, Brazil). However, one important factor is missing in the figure – the strength of the currencies of the various players. If a disaster strikes the United States, (issues with inflation aside) the US can just print more money to satisfy immediate needs. Brazil and other developing countries cannot do the same.

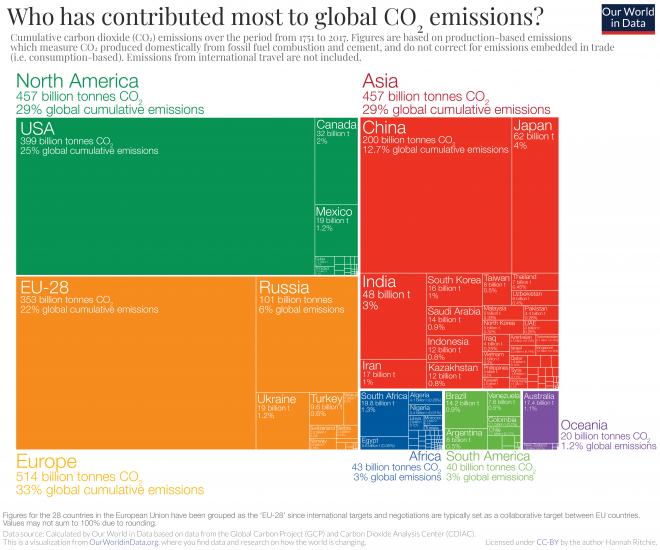

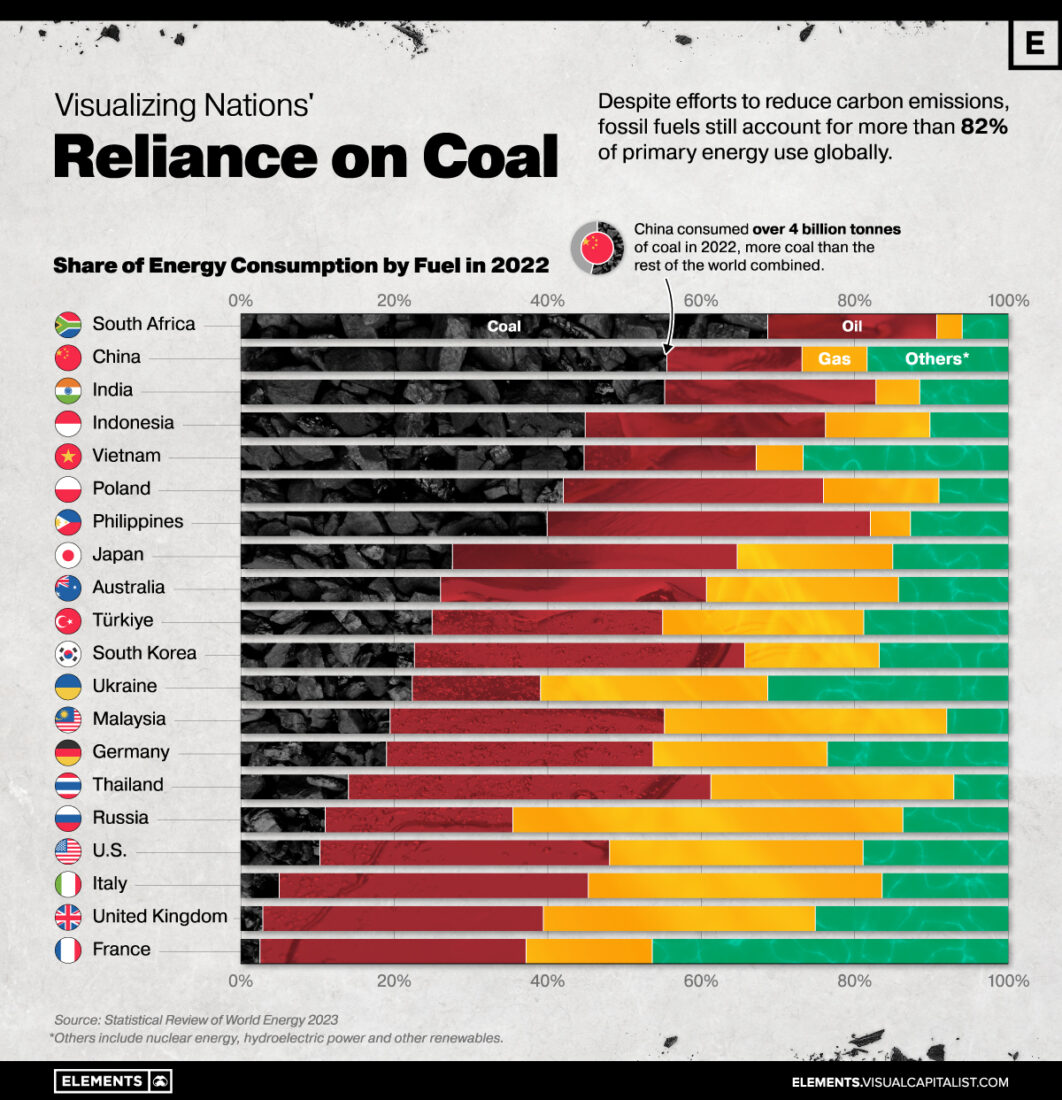

Figures 2 and 3 show two important factors in play that should convince rich countries to help poor countries face the destructive impacts of climate change.

Figure 2 shows the cumulative global contributions to carbon emissions, the main driver of today’s changes in atmospheric chemistry, and therefore the main culprit for accelerating climate change. The two leading contributors to this accumulation are the US and the European Union.

Figure 2 – Cumulative global contributions to carbon emissions (Source: Our World in Data)

Figure 3 – Share of energy consumption by fuel (Source: Visual Capitalist)

Global players such as the UN do not have the effective enforcement power required for reparations. Figure 3 shows the energy/fuel consumption of fuels for a list of countries and blocks of countries that roughly correspond to the G20 country collections. The largest coal consumers are developing countries (South Africa, China, India, etc.). The atmosphere is global and carbon dioxide (the most prevalent greenhouse gas) spreads easily throughout. Therefore, a good self-empowering argument can be raised for rich countries to help poor countries in the adaptation and mitigation of climate change. Doing so will actively participate in the global energy transition away from using coal, the most polluting energy source.

The largest threat that is starting to convince rich countries that it is in their self-interest to help developing countries confront climate change, comes from the unavoidable results of failure. This is also transparent in the fate of Libyan survivors of the deadly floods in Derna. The threat is the uncontrolled increase in environmental refugees who feel that their livelihoods and even lives are being destroyed. They find their countries unable to confront the destruction, forcing them to try to search for shelter in countries with better chances of confronting the danger.

I wrote about this issue in previous blogs (see April 3, 2018) and every semester I show my students a film about the issue made by the American army (The Age of Consequences) that shows that the border security of the rich countries is threatened by an increasingly large number of people who feel no longer safe in their own country.

For the first time, last year, in the COP27 global climate meeting, this issue took center stage (see November 22, 2022 blog). It is a certainty that this issue will be central in the coming COP28 conference in the United Arab Emirates.

There are two international organizations that have it in their charters to help developing countries confront global economic threats, these are the World Bank and the IMF (International Monetary Fund). The next blog will focus on these organizations.

Stay tuned.

Hello professor,

I notice that the two vulnerable cities you mentioned, Derna and Lahaina, are in disenfranchised areas. Their disasters received news coverage for a week or so, then it died off. But the devastated people did not die off.

This reminds me of a theory I have: the reason there are so many climate change deniers in the US is that they cannot see the effects of climate change. The US has a lot of infrastructure– however imperfect– to protect its people from climate deniers. Even if the infrastructure fails, it’s easy for the media to push that under the rug. When climate deniers are never faced with the effects of climate change, they can pretend it doesn’t exist, or even outright deny its existence.

Additionally, I think empathy fatigue is a factor here. Seeing so many climate disasters on the news can numb you. It’s a difficult balance to strike.

Thank you,

Niamh Zanghi

Hi Professor,

The part that stuck with me the most in this blog is your comparison of data between the countries. I liked the fact that you mention the true difference between rich and poor countries when it comes to debt. Although the numbers vary quite little in figure 1 when it comes to government, household and corporate debt, the true difference lies in their ability to handle the debt. Like you mentioned, a rich country like the U.S. is able to just print out more money to balance the crisis. However, for poor countries like Brazil, they simply just can’t do the same. This should also be ways in addition to figure 2 and 3 to convince rich countries to help poor countries face the effects of climate change.

Thank you,

VingGa

It is important to consider the debt dilemma that developing nations face and how it can affect their economy, healthcare, education, and general well-being. The difficulty these countries face in attracting long-term international attention and the fact that financial crises always resurface despite prior attempts at rescue emphasize how complicated the situation is. A significant issue regarding the strength of currencies in rich and poor countries is brought up by the inclusion of Figure 1, which shows the debt-to-GDP ratio. The difference in financial resilience is highlighted by contrasting the limited options available to underdeveloped countries with the capacity of wealthier nations, such as the United States, to issue more money during times of crisis. It might be difficult for developing countries to maintain international attention for their economic hardships. Despite prior attempts at rescue, financial crises seem to be returning, showing the need for longer-term fixes that deal with the underlying causes of these economic problems.